Easy Home Loans Calculator

Get your easy home loan – Simpler, faster, and at competitive rates. Start on your fast estimate now!

Quickly Compare Home Loans at Competitive Rates

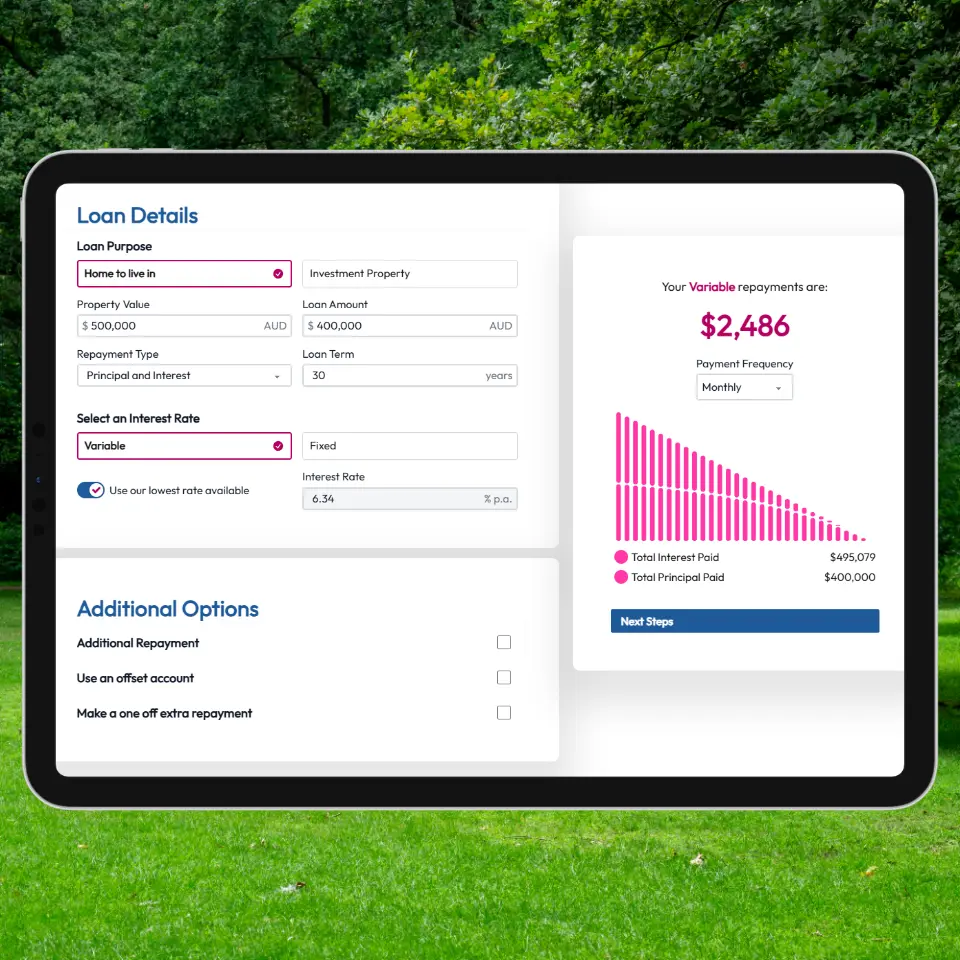

Quickly and easily compare interest rates and lenders based on your specific loan with our easy-use calculator. The device calculates estimates for both variable and fixed rate options to give property buyers reliable and relatable comparisons rather than relying on percentage comparisons.

The Australian property lending market is vast, and rates vary not only with lenders, but on different lending products and for different lender profiles. Buyers can use the device to get estimates for the amount they want to borrow for refinancing an existing loan, a new loan, for investing in property, building a house by using the relevant rate for the product required.

Rates from other lenders can easily be compared with our highly competitive rates to ensure borrowers that in using our services, they are dealing with experts.

To get your comparisons and for your specific best rate, request a quote.

How do we secure such competitive property loan rates? Through our large lender connections and specialist expertise. We are accredited with more than 80 lenders, including Australia’s major banks, other banks, and other non-bank property finance providers. We have the latest systems to assist our brokers quickly cover the market and stay across new product releases and rate fluctuations. Let us find you the best rates – connect with us now!

- 80+ lenders for highly competitive home loan rates.

- Specialist home loan brokers, extensive market coverage.

- Online calculator for quick rate comparisons.

Read more...

Take much of the complexity and the much of the time out of finding your ideal loan with our specialist property finance services. Get the best mortgage rates from 80+ lenders. Have our experts find you the most suitable loan product and handle your individual requirements.

Accessing our specialist services is direct with no referral required for buyers requiring all types of property finance. Connect with us now or start with getting quick estimates using our property loan calculator.

Request a quote online or by phone.

Streamline Securing Your Property Finance with Yes Home Loans

One connection with us and property buyers have access to a vast portfolio of loan products and options to suit all types of property acquisitions. Loan products vary across the lending market with varying features and benefits offered by lenders including different rates – variable, fixed and split, varying terms, variations with LVRs and approved deposits as well as the overall guidelines for loan approval. Using our services eliminates the need for buyers to contact multiple lenders to source rates, consider different loan options and get quotes. Our brokers find the most suitable product for owner-occupiers, refinancers, investors, first-home buyers, low deposit buyers, renovators, those building a house and those looking to use equity in their property on a new loan.

Finance to purchase investment properties varies from mortgages for owner-occupiers. Interest rates are higher on investment property finance but lower deposits, 10%, are typically accepted. The focus for investors is on securing finance that will deliver on their objectives for ROI, tax benefits, and overall capital growth. Our brokers are highly skilled in sourcing and structuring finance solutions to specifically meet investor objectives. Speak with one of our experts to discuss your requirements.

When the time comes to refinance an existing property loan, mortgage holders will be seeking the best rates and a workable, affordable solution. When refinancing, homeowners have the choice of negotiating a new loan with their current lender or switching to a new lender, changing between a fixed and a variable rate, and selecting a totally different lending product. Lenders are regularly releasing new lending products into the market. Our brokers are across what is available and assist by sourcing and presenting the most affordable options that suit specific objectives. Book a mortgage consultation to discuss your mortgage refinancing requirements with one of our brokers.

For buyers that do not have the full 20% deposit, there are lenders that will approve property finance based on a 5-10% deposit, subject to borrowers meeting approval criteria. These low deposit mortgages can attract higher rates and Lender Mortgage Insurance. To assist in making decisions around the deposit you should aim for, use our loan calculator. Estimated repayments can be quickly calculated with different borrowing totals to reflect different deposits, and the estimates compared. For a specific quote and to check your eligibility for a low deposit mortgage, connect with us.

Specialised construction loans are available to finance major renovation works and the building costs of new dwellings. These lending products are provided either as a drawdown facility or the funds extended as required to meet the builder’s progress payment invoices. The application requires not only the financials of the applicant, but details and documents on the project. Plans that have been approved or submitted to council are required. The builder’s quote is also required. Homeowners looking to prepare a building or renovation budget can use our calculator to obtain estimated repayments on construction loans to assist.

Direct Access to Comprehensive Loan Selection

One connection with us and property buyers have access to a vast portfolio of loan products and options to suit all types of property acquisitions. Loan products vary across the lending market with varying features and benefits offered by lenders including different rates – variable, fixed and split, varying terms, variations with LVRs and approved deposits as well as the overall guidelines for loan approval. Using our services eliminates the need for buyers to contact multiple lenders to source rates, consider different loan options and get quotes. Our brokers find the most suitable product for owner-occupiers, refinancers, investors, first-home buyers, low deposit buyers, renovators, those building a house and those looking to use equity in their property on a new loan.

Easily Secure Cost-effective Investment Property Financing

Finance to purchase investment properties varies from mortgages for owner-occupiers. Interest rates are higher on investment property finance but lower deposits, 10%, are typically accepted. The focus for investors is on securing finance that will deliver on their objectives for ROI, tax benefits, and overall capital growth. Our brokers are highly skilled in sourcing and structuring finance solutions to specifically meet investor objectives. Speak with one of our experts to discuss your requirements.

Affordable Refinancing Solutions

When the time comes to refinance an existing property loan, mortgage holders will be seeking the best rates and a workable, affordable solution. When refinancing, homeowners have the choice of negotiating a new loan with their current lender or switching to a new lender, changing between a fixed and a variable rate, and selecting a totally different lending product. Lenders are regularly releasing new lending products into the market. Our brokers are across what is available and assist by sourcing and presenting the most affordable options that suit specific objectives. Book a mortgage consultation to discuss your mortgage refinancing requirements with one of our brokers.

Specialist Low Deposit Property Loan Expertise

For buyers that do not have the full 20% deposit, there are lenders that will approve property finance based on a 5-10% deposit, subject to borrowers meeting approval criteria. These low deposit mortgages can attract higher rates and Lender Mortgage Insurance. To assist in making decisions around the deposit you should aim for, use our loan calculator. Estimated repayments can be quickly calculated with different borrowing totals to reflect different deposits, and the estimates compared. For a specific quote and to check your eligibility for a low deposit mortgage, connect with us.

Construction Loans Structured to Suit Your Project

Specialised construction loans are available to finance major renovation works and the building costs of new dwellings. These lending products are provided either as a drawdown facility or the funds extended as required to meet the builder’s progress payment invoices. The application requires not only the financials of the applicant, but details and documents on the project. Plans that have been approved or submitted to council are required. The builder’s quote is also required. Homeowners looking to prepare a building or renovation budget can use our calculator to obtain estimated repayments on construction loans to assist.

No Referral Required! Direct Connect with Yes Home Loans Expert Mortgage Brokers, Australia-wide Services

- Save time sourcing multiple options.

- Personalised home loans services.

- Access to the latest home loan products.

- Specialised options for building and renovation projects.

- Opportunities for low deposit home buyers.

Get Fast Estimates with Our Home Loans Calculator

Get quick estimates on your choice of property loan using our finance calculator. The calculator quickly generates estimates based on the numbers entered by the user. Allowing buyers to compare repayment estimates for different property prices, to budget for construction costs, and to compare different loan options based specifically on the property they are considering.

The calculator is formulated with the latest technology to ensure buyers receive reliable figures to support their decisions and assist with progressing their property ownership objectives. To get your estimates, enter the interest rate and the relevant term for the lending product you require with the amount you are seeking for your loan. Instantly, the calculator does the computations and displays the estimated repayment. For a specific repayment schedule, request a quote.

- User-friendly home loan calculator.

- Compare repayment estimates based on property prices.

- Online accessibility, all types of lending product estimates.

Simplified Applications, Fast Approvals with Best Rate Home Loans

Make the process of applying for property finance easier with our streamlined approach and the guidance and support from our brokers. We assign individual brokers to each customer, ensuring you have personal service and prompt attention to your specific requirements. We’ll advise what documents and details are required for your application and handle processing the application with our lenders to secure fast approval.

Applying for finance when first embarking on the property purchase journey and prior to purchase can be extremely beneficial. We process applications before purchase to provide buyers with their exact borrowing capacity to enable them to select properties within their budget. For prompt attention to your individual property loan requirements, book a property loan consultation.

Most Frequently Asked Questions About Mortgages

How do I know if I will have to pay Lender Mortgage Insurance?

Lender Mortgage Insurance applies to mortgages taken out with low deposits. Low deposits are classified as less than the standard 20% and may be 5-10%. Lenders will advise if LMI applies to an individual loan when a quote is provided.

How do you use a home loan calculator?

A home loan calculator is used to calculate estimated repayments. Users input the amount they want to borrow and the interest rate and term for the type of loan they are interested in. The calculator works out the monthly repayment estimate based on those figures. The figures can be changed to get an estimate on another set of figures to compare rates and property prices.

Can I get a pre-approved mortgage so I know my borrowing capacity?

Yes. Property buyers can apply for a loan prior to purchase. Lenders assess the applicant’s income, assets, financials and credit profile to determine their borrowing capacity – the amount they would be approved to borrow. Applications can be made based on an indication of the property price and type being considered. Conditional approval is given and the details amended and finalised when the purchase is made.

What is the LVR?

The LVR is the loan-to-value ratio of an individual loan. It is the percentage of the amount being borrowed compared with the price or value of the property. LVRs can determine the risk to lenders, the interest rate and if LMI applies to the loan.

Can I get finance to add an extension to my property?

Major structural works to an existing dwelling such as an extension may be financed with a construction loan. This type of finance is structured differently from standard mortgages. They may be structured with the funds available when builder payments are due or as a drawdown account. The application requirements and other features vary from standard mortgages.

What is a mortgage broker?

A mortgage broker is a professional in the property lending market who provides a service to assist property buyers with their finance. Brokers work with the lenders they are accredited with to source the most suitable loan and best rates on behalf of their buyer customers.

What is needed to apply for a home loan?

To apply for property finance, applicants will be required to provide details of their income, employment, assets and liabilities, expenses and details of the property being financed. Details of the deposit available for the mortgage are required. A valuation from a licensed valuer is generally requested by the lender.

What is the difference between a variable and a fixed interest rate?

A fixed interest rate is offered over a fixed period, which may be 2-4 years of the mortgage. The rate remains unchanged over that period as do the monthly repayments. Variable rates may be offered for indefinite terms. These rates are subject to fluctuations in rates as decided by lenders. When rates change, the repayments also change.

What deposit is required for an investment property mortgage?

Investment property mortgages may be approved with 10% deposit, subject to individual lender criteria and guidelines.

Can I get a home loan with a 10% deposit?

Mortgages with a 10% deposit may be approved by some lenders to borrowers that meet the lender criteria. Low deposit mortgages attract Lender Mortgage Insurance and generally higher rates than 20% deposit mortgages.

Let Yes Home Loans simplify the process by taking care of the complicated steps for you